REASONS A LOW DOWN PAYMENT MORTGAGE MAY MAKE SENSE

Even if you do not have a lot of savings, you may still qualify for a mortgage. Many options require far less than 20 percent down, even though 20 percent is still seen as a benchmark. In fact, the practice of making a much smaller down payment is fairly common.

For example, government-backed mortgage loans from the Federal Housing Administration (FHA), Veterans Affairs (VA), and Fannie Mae all require substantially less than 20 percent down. Many banks also offer their own loans that require less than 20 percent down, including conventional 30-year fixed mortgages with lower down payment requirements.

Does a Mortgage Down Payment Below 20 Percent Cost More?

Over the life of a loan, a lower down payment will typically cost more. There are several reasons for this. First, if you make a lower down payment, you need to take out a larger loan to buy the same size house. This means that you will have to pay off more principal and that your share of total interest paid will be correspondingly larger. You will also have higher monthly payments than if you had put down 20 percent on a mortgage of the same term.

Second, low down payment mortgages are often seen as riskier for the lender, so your bank may charge you a higher interest rate than if you had put down 20 percent or more. Third, many low down-payment programs require you to take out private mortgage insurance, or PMI, to further defray the risk to the lender. This also adds to the cost of a low down-payment mortgage.

What are the Pros of a Low Down-Payment Mortgage?

There are several advantages to making a low down-payment. First, you can buy a house much sooner than if you had to save for a large down payment. This can be especially advantageous if you have your eye on a specific house that just came on the market, or if you live in an area with overheated rental prices. In the latter instance, your monthly mortgage payment may be less than monthly rent for a similar living situation.

A second advantage of a low down-payment is that you can start to build equity in real estate sooner. Third, you are not necessarily locked into the mortgage for the entire time you live in the home. You could at some point refinance into a mortgage with more favorable terms, particularly if the home’s value skyrockets, or if you come into more money. Fourth, many government-backed programs alleviate some of the downside of low down-payment mortgages. For example, an FHA mortgage typically offers an interest rate for low credit-score borrowers that is better than they would receive with a conventional mortgage. In instances like these, a specific low down-payment program may be particularly appealing.

What Percent Down Payment on a House Makes Sense?

The amount of money you want to put down really depends on your personal situation. Likely, several factors will go into the decision:

Your Savings. The more savings you have, the more you could put down. However, there are always other factors to consider. Even if you have the cash to achieve a 20 percent down payment, you may choose to use your savings otherwise. Keeping a large emergency fund, building toward other savings goals, and preparing for major upcoming expenses may all preclude you from putting down 20 percent.

Your Income Stream. Do you have a regular, reliable source of income? How much is it? If you have a large income, but do not yet have much savings, a low down-payment can maximize the benefit of your future earnings.

Property Value Projections. One danger of a low down-payment is that if your property value drops, you are more likely to find yourself “underwater,” meaning your mortgage loan is larger than your home is worth. In this situation, you would have to pay the difference to sell your home. On the flip side, if your property value jumps, you may quickly gain over 20 percent equity in your home – and be able to refinance into a conventional 20-percent equity loan with a lower rate and no PMI.

Your Desired Monthly Payment. A lower down payment means a higher monthly payment. For some people, this is expected and okay. Others find it stressful, or find themselves “house poor,” meaning an unusually large proportion of their monthly expenses go towards their home. As a result, they are unable to enjoy their customary spending on dining out, entertainment, and vacations.

Available Programs. Often, a decision about a lower down payment is tied to a specific program offered by the government or a bank. If there is an available program that gives you specific benefits or that targets your needs well – such as a doctor loan offered by some banks – putting down less than 20 percent makes a lot of sense.

What Are the Differences Between Low Down-Payment Programs?

There are many low down-payment programs available, each of which has slightly different benefits and drawbacks. For example, an FHA loan has among the lowest credit score thresholds, but also includes the most stringent mortgage insurance requirements. Doctor Loans and VA Loans often do not require any money down – but are only available to individuals who are doctors or associated with the military. The best way to learn about all your options is to talk directly with a local residential lender.

Four Common Low Down-Payment Programs

| Doctor Loans | FHA Loans | VA Loans |

HomeReady Loans |

|

| Available to: | Doctors, medical residents, dentists in some cases | Low-income, low-credit score individuals. Popular with first-time buyers |

Service members, veterans, eligible surviving spouses |

Low-income, low-credit-score individuals who take homebuying course |

| Minimum Down Payment for Most-Qualified Buyers | 0% | 3.5% |

0% |

3% |

| Minimum Credit Score Requirement | Varies | 580 | Varies | 620 |

| Mortgage Insurance Requirements | Usually none | Upfront and monthly; cannot cancel | None | Monthly; can cancel once 20% equity reached |

If you find one of these programs appealing, talk with your local Residential Lender to see if you qualify. Also, keep in mind that these are not the only programs available with low down payments. Conventional mortgages also do not always require 20 percent down. Other products with low down payment possibilities include Jumbo Mortgages and Construction Loan Programs – talk to your lender about all your options.

Spotlight: Special Doctor Mortgage Loans

A Doctor Loan, or a Physician Loan, is a product that banks extend to doctors, medical residents and occasionally dentists, who have just launched their careers. In many cases, early-career doctors have substantial annual income, but very little savings – and often substantial debt – due to the cost of medical school.

The loan is based on the promise of the borrower’s future income, while making allowances for the borrower’s limited cash reserves and high debt-to-income ratio. The specific down payment amount required varies based on the lender and the borrower’s situation. In most cases, it is substantially less than the traditional 20 percent. Typically, PMI is not required, which presents significant savings over the life of the loan.

Learn About Physician Mortgage Loans

What Do You Need to Get Approved for a Mortgage?

To get a mortgage, you will need to prove to your lender that you have the cash to make your down payment (even if it is less than 20 percent), as well as reliable cash flow to make your monthly mortgage payments. Your finances will be reviewed very closely.

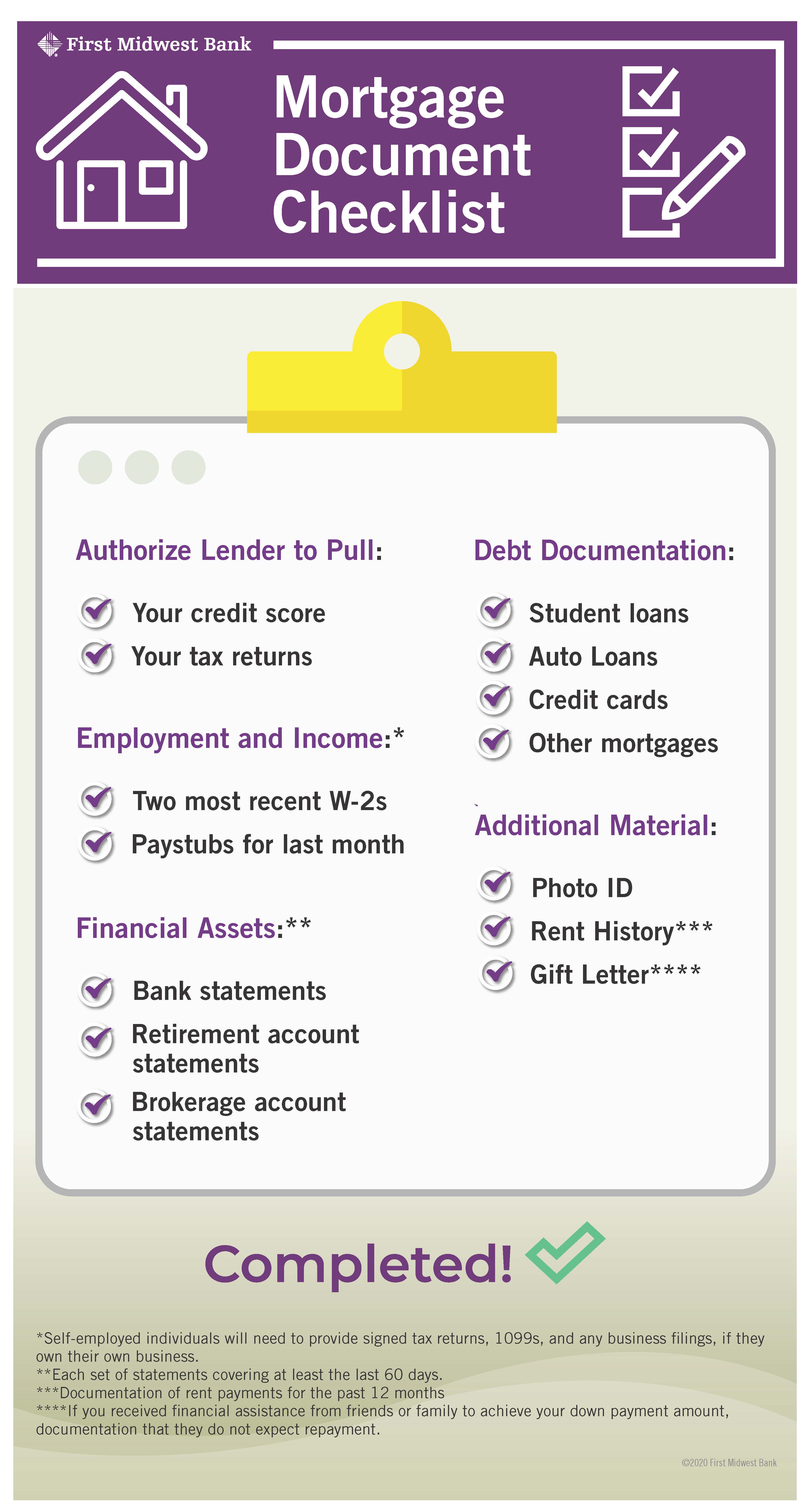

Expect to provide significant documentation. Your credit will be scrutinized, and your bank accounts will be analyzed. Some clients find the process invasive, but it is necessary to secure the loan. To minimize back and forth with your lender, use a checklist to provide all the documentation at once.

Selecting a Mortgage Lender

When it comes to a mortgage lender, a good fit is important. You will be working together for approximately two months – starting when you get serious about making an offer and ending the day you close on your home.

Many real estate agents advise choosing a local lender with community connections and the bandwidth to personally manage your closing, including helping you through any hiccups you may encounter. A personal touch and a knowledge of the local market can go a long way toward a smooth closing process.