HOW AN ADJUSTABLE RATE MORTGAGE MAY BENEFIT YOU

If you are planning to buy a new home, you probably also have mortgages on your mind. How do you choose the right one? As you are considering, it pays to understand the mechanics of each product. Today, we will focus on an adjustable rate mortgage, or ARM. This is a common alternative to a conventional fixed rate mortgage.

What is an Adjustable Rate Mortgage?

An adjustable rate mortgage, or ARM, has a changing interest rate. The initial rate is fixed for a set period, after which it moves at regular intervals. The borrower’s adjusted rate usually changes annually, based on a benchmark plus the borrower’s margin percentage.

For example, a borrower may take out a mortgage of $100,000, with an interest rate of 4.5% for the first five years. After five years, if the benchmark sits at 3.5%, and the borrower has agreed to pay a 2.0% margin, the new rate would be 5.5%. This rate then adjusts annually for the remainder of the loan. The rate can go up or down, depending on the benchmark.

In contrast, a fixed rate mortgage has one rate for the life of the loan. While a fixed rate offers rate security, there are some benefits to an adjustable rate mortgage.

Connect with a Mortgage Lender

Adjustable Rate Mortgage Pros and Cons

The main advantage of an ARM is the initial rate, which is typically lower than that of a conventional fixed rate mortgage. This rate is temporary and the result of taking on the risk of rate variations for much of the loan. An ARM may make sense if you:

- Are planning to move or refinance after several years

- Don’t believe rates will rise or believe they will drop

- Are comfortable paying a variable rate after a certain period

- Have calculated a substantial savings based on the lower initial rate

The fluctuating nature of rates gives an ARM an element of unpredictability. These mortgages are typically 15 or 30 years, so the final rate may differ substantially from the initial rate. As a result, the product may not make sense if you:

- Value the stability of predictable payments

- Could not afford an increase in your monthly payment

- Have no desire to move or refinance

- Don’t receive a substantial savings in the initial rate

A conventional fixed rate loan is often the comparison point for borrowers who are considering whether they would like an ARM.

Adjustable Rate Mortgage vs Fixed Rate

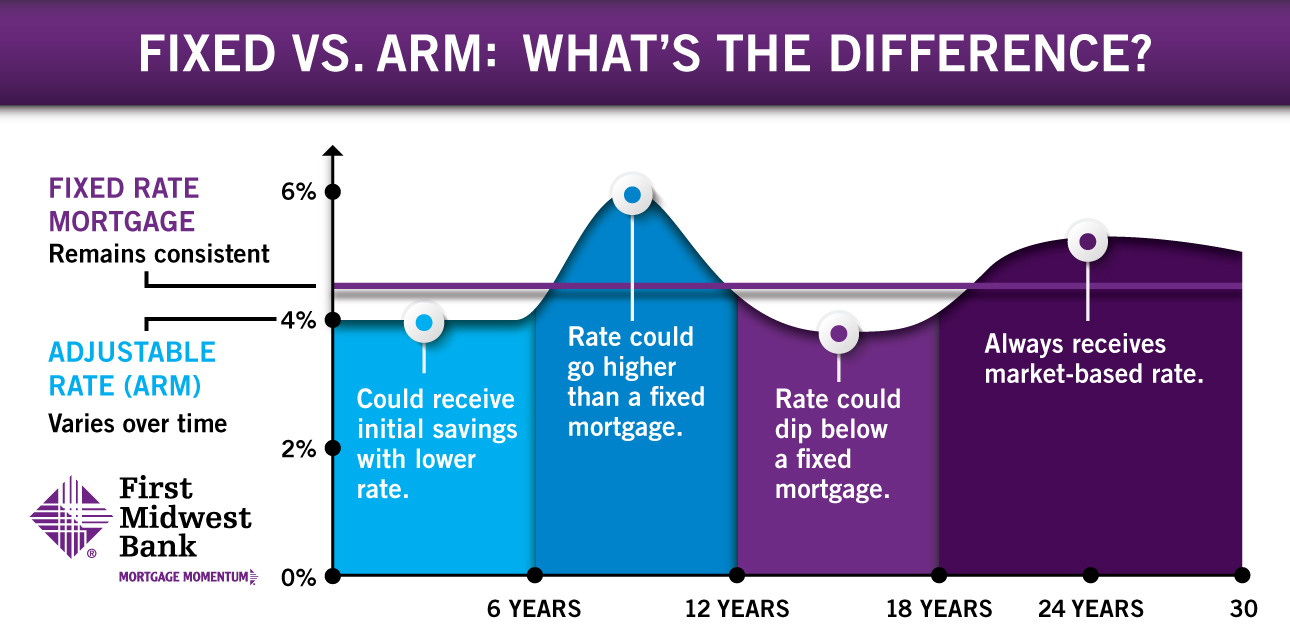

A fixed rate mortgage offers stability, while an ARM offers the opportunity for savings within variability.

As you can see, a main factor in the decision of whether to choose an ARM is the initial rate you could receive, as compared to the rate you could receive on a fixed rate mortgage.

Adjustable Rate Mortgage Calculator

The cost of an ARM vs a fixed rate mortgage depends on a variety of factors, including how long you plan to stay in your home. A calculator is a first step, to give you an idea of what might make sense.

You can get a fuller picture by speaking with a local residential lender , who has experience helping borrowers choose among a variety of mortgage options.

Connect with Your Local Mortgage Lender

A lender can conduct a thorough review of your finances and, coupled with an understanding of your goals, likely provide several loan options tailored for you.

Or, if you would like more details on the nitty-gritty of adjustable rate mortgages, keep reading to learn about ARM fixed rate and adjustment periods, adjustment caps, benchmarks, and margins.

Types of ARMs: What is a 5/1 ARM?

Lenders typically use shorthand to describe key ARM components. A 5/1 ARM means the mortgage has an initial fixed-rate period of five years, with rate adjustments once a year thereafter. A 7/1 ARM means a seven-year fixed-rate period, while a 5/6 ARM means a five-year fixed-rate period, with rate adjustments every six months thereafter.

ARMs also have adjustment caps, so that the borrower is protected from severe rate changes. For example, a 2/2/5 cap means that the first adjustment to an ARM can be a maximum of 2.0%, that each later adjustment must be no more than 2.0%, and that the rate is capped at a 5.0% total adjustment up or down.

For example, consider a 5/1 ARM that has an initial fixed rate of 4.0% with a 2/1/5 cap structure. The most a borrower could pay after the first adjustment would be 6.0%, as specified by the 2.0% initial cap. In subsequent adjustments, the rate change could not exceed 1.0%, as specified by the periodic cap. And, as outlined by the lifetime cap, the borrower could never pay more than 5.0% above the initial rate, meaning the rate for this loan could not exceed 9.0%.

How Are Rate Adjustments Determined?

Rate adjustments are tied to a market index, also known as a benchmark. These indexes track interest rates on a regional, national, or global level. Some commonly used indexes are:

- Constant Maturity Treasury (CMT). The 1-year CMT, or 1-year T-Bill, is perhaps the most common ARM index. The CMT is based on daily calculations of the U.S. Treasury yield curve.

- London InterBank Offered Rate (LIBOR). A global benchmark based on the rates major international banks are lending each other money. LIBOR may be phased out in 2021.

- Prime Rate. A national rate based on the lending rates U.S. banks are offering highly creditworthy customers. Published by the Federal Reserve and the Wall Street Journal.

- Cost of Funds Index (COFI). Calculated monthly, this benchmark represents an average of interest rate expenses incurred by U.S. banks. Can be regional (based on the region of the borrower) or national.

What is an ARM Margin?

In addition to the index, a borrower must also pay a margin, or a specified percentage above the index. A borrower’s newly adjusted rate is the index plus the margin. For example, imagine a borrower with an ARM indexed to a 1-year T-Bill, and a margin of 3.5%. If, during the rate adjustment period, the 1-year T-bill sits at 1.7%, the borrower’s new rate would be 5.2%.

The margin does not vary during the life of the loan. It is an agreed-upon percentage the borrower pays above the benchmark, once the ARM becomes variable. The size of the margin substantially affects the value of the loan and can be a point of negotiation during mortgage shopping. Typically, borrowers with higher creditworthiness are asked to pay smaller margins.

What Are Current Rates on Adjustable Mortgages?

ARM mortgage rates depend on a changing interest environment, each individual borrower’s credit worthiness, and the type of ARM requested. Other factors include the amount of money the borrower puts down, the type of home purchased, and the lending institution.

As you develop your homebuying plans, the best way to learn what rates are available is to talk directly with a local residential lender. You will receive a thorough review your finances, along with suggestions for mortgages that may fit your needs.