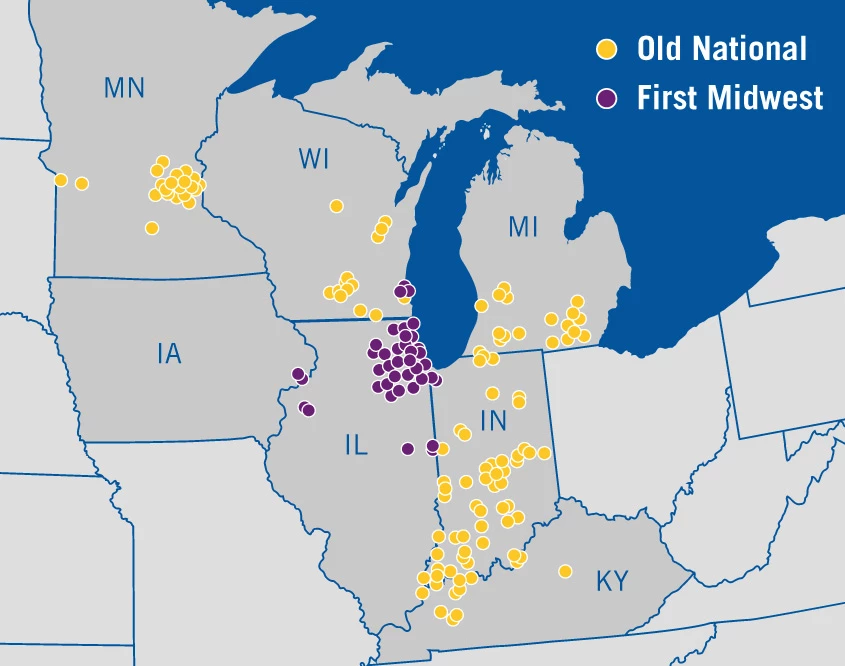

In June 2021, First Midwest announced a merger of equals with Old National, the largest financial services bank holding company headquartered in Indiana. This merger was officially completed in February 2022, making First Midwest a division of Old National until offices and computer systems can be fully integrated in July 2022. This powerful combination, with $46 billion in total assets and dual headquarters in Evansville and Chicago, provides even greater convenience for clients with expanded access to more than 250 banking centers across the Midwest.

Middle Market, Business Banking, Treasury Management, Specialty Finance, ESOP, Healthcare, Commercial Real Estate and Equipment Leasing

More than 250 locations and dedicated Consumer, Small Business, Mortgage and eCommerce teams

Full-service Wealth Management capabilities, including Private Banking, Fiduciary and Investment Management Services

We are proud to share our inaugural Corporate Social Responsibility (CSR) Report: Momentum for All.

Being a good corporate citizen has been a part of First Midwest’s DNA since the founding of our company. This report brings to life what we are all about—how we express our character, how we live our mission and values and how we hold ourselves to the highest standard in doing so.

In the aftermath of the Great Depression, C.D. Oberwortmann, Andrew Barber and Frank Turk made a personal commitment to bring quality banking back to the Joliet, Illinois area. In 1940, they founded Union National Bank and Trust Company of Joliet.

The bank’s original slogan was “The Friendly Bank,” which summarized the founders’ commitment to creating an institution that, first and foremost, served its community by making banking services conveniently available to customers. Since then, First Midwest has grown and evolved significantly, but our mission remains unchanged: helping our clients achieve financial success in the communities in which we live and work.

1940 – Andrew Barber, C.D. Oberwortmann and Frank Turk opened the Union National Bank and Trust of Joliet.

1940 - 1970 – Expanded presence in the northern and western suburbs of Chicago, southern Illinois and the Quad Cities.

1982 – Working with the Illinois Bankers Association, shaped new Illinois Banking Act that allowed banks to form multi-bank holding companies

1983 – Merged 20 banks under First Midwest Bancorp, the largest number of banks consolidated at one time in Federal Reserve history.

1983 – FMBI began trading on NASDAQ

1983 – Developed current First Midwest corporate logo

1987 – Appointed Robert O’Meara CEO

1995 – Expanded into western Iowa; First Midwest’s first interstate acquisition

1995 – Consolidated four bank charters into a single bank in Illinois

1996 – Changed from national to state bank charter

1998 – Expanded into Southern Metro-Chicago suburbs

2000 - 2002 – Opened loan operations and deposit operations centers: the Robert P. O’Meara Center in Gurnee and the John Racich Center in Joliet

2003 – Appointed John O’Meara CEO

2003 – Established the First Midwest Charitable Foundation

2006 – Expanded into northwest Indiana

2008 – Appointed Mike Scudder Chairman and CEO

2016 – Surpassed $10 billion in total assets

2018 – Relocated headquarters to Chicago

2019 – Expanded into southeast Wisconsin

2021 – Announced merger of equals with Evansville, Indiana-based Old National

2022 – Completed merger of equals with Old National to become First Midwest Bank, a division of Old National

This is a link to a third-party site. Note that the third party's privacy policy and security practices may differ from First Midwest Bank's standards. Complete details regarding third-party links are available in our Terms of Use.

Residents of California have certain rights regarding the sale of personal information to third parties. First Midwest Bank, our affiliates, and service providers use information collected through cookies or in forms to improve the experience on our site and pages, to analyze how our site is used, and to present personalized advertising.

At any point, you can opt-out of the sale of your personal information by selecting Do Not Sell my Personal Information.

You can find more information and how to manage your privacy choices by reviewing our California Consumer Privacy Disclosures located on our Privacy information page by following the link on the bottom of any page.